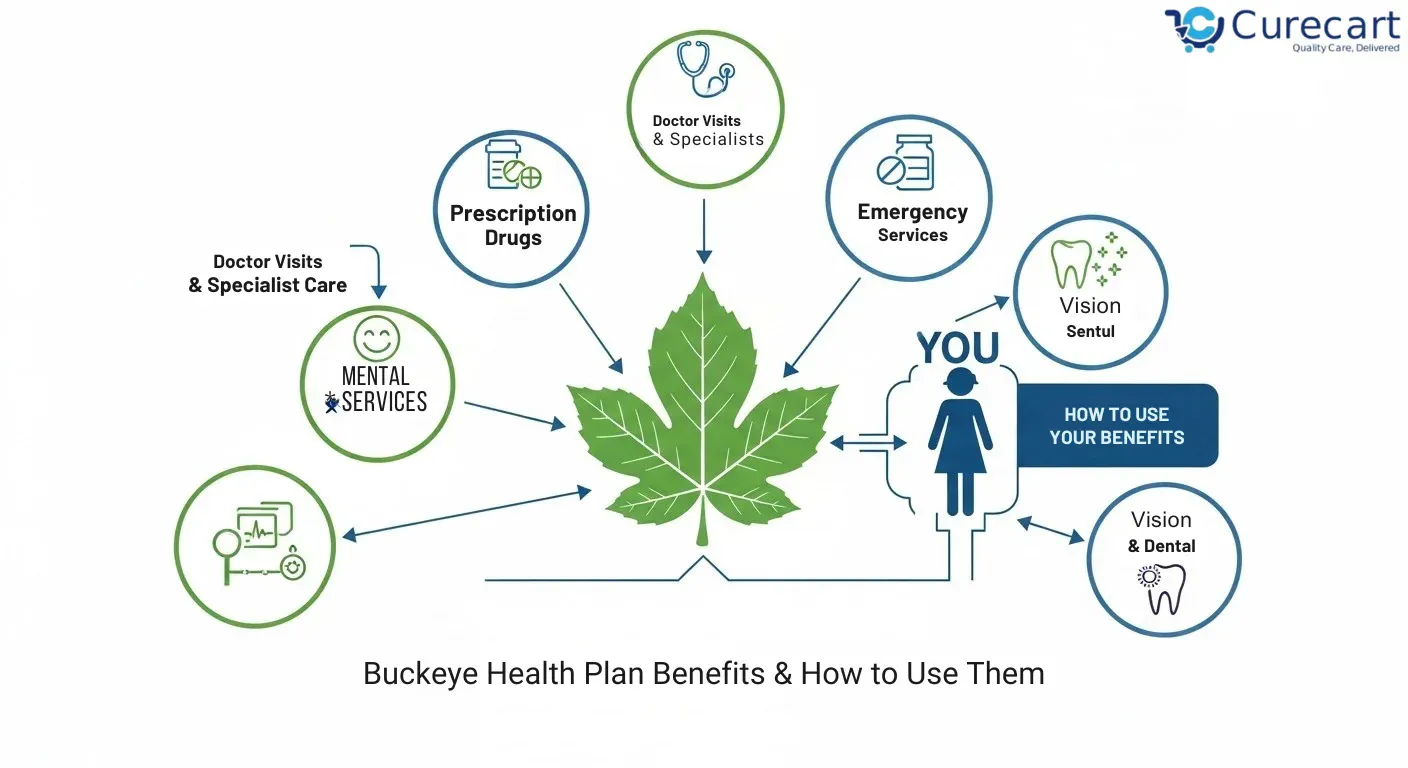

Buckeye Health Plan Benefits & How to Use Them

Navigating health insurance can feel overwhelming, but understanding your Buckeye Health Plan benefits doesn’t have to be complicated. Whether you’re a new member or looking to maximize your coverage, this guide breaks down everything you need to know about using your plan effectively.

These plans often include primary care, prescriptions, dental, and vision services at little to no cost, along with additional benefits like a Healthy Rewards program, transportation assistance, and Over-the-Counter (OTC) allowances.

What is Buckeye Health Plan

Buckeye Health Plan is a managed care organization that provides Medicaid and Medicare coverage to eligible individuals in Ohio. The plan partners with a network of healthcare providers to deliver comprehensive medical services, from routine checkups to specialized treatments.

As a member, you gain access to preventive care, prescription medications, mental health services, and more often at little to no cost. The key is knowing what’s covered and how to access these benefits efficiently.

Core Benefits Covered by Buckeye Health Plan

Medical Services:

Your plan covers essential healthcare services including doctor visits, hospital stays, emergency care, and outpatient procedures. You can see your primary care physician for annual wellness exams, which are fully covered and don’t require a copay.

Specialist visits are also included when you have a referral from your primary care doctor. This ensures you receive coordinated care while keeping costs manageable.

Prescription Drug Coverage:

Buckeye covers both generic and brand-name medications through participating pharmacies. Most prescriptions have low or no copays, making it easier to stay on top of chronic conditions or short-term treatments.

You can check which medications are covered by reviewing the plan’s formulary—a list of approved drugs organized by tier. Generic medications typically cost less than brand names.

Preventive Care:

Preventive services are the backbone of good health management. Your plan covers immunizations, cancer screenings, annual physicals, and wellness visits at no additional cost. These services help catch potential health issues early when they’re most treatable.

Women have access to prenatal care, mammograms, and cervical cancer screenings. Children receive well-child visits, developmental screenings, and vaccinations according to recommended schedules.

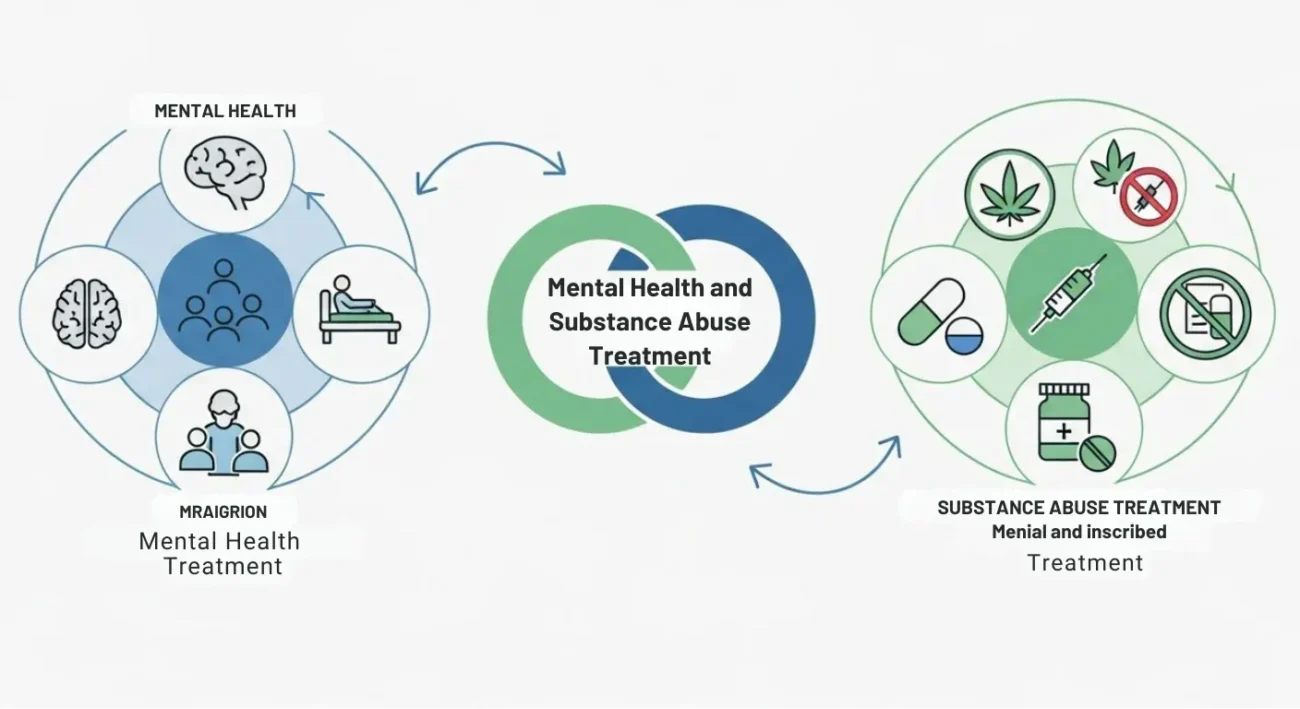

Mental Health and Substance Abuse Treatment

Mental health is just as important as physical health. Buckeye provides coverage for counseling, therapy sessions, psychiatric evaluations, and inpatient treatment for substance abuse disorders.

You can access these services through in-network mental health providers. Many members don’t realize these benefits exist, so don’t hesitate to use them if you’re struggling.

Dental and Vision Care:

Depending on your specific plan type, you may have coverage for routine dental cleanings, fillings, extractions, and emergency dental care. Vision benefits often include annual eye exams and eyeglasses or contact lenses.

Check your member handbook to confirm what’s included in your particular coverage tier.

Transportation Assistance:

Getting to medical appointments can be a barrier for many people. Buckeye offers non-emergency medical transportation to help members reach scheduled doctor visits, pharmacy pickups, and other healthcare-related appointments.

You need to request transportation in advance usually at least two business days before your appointment. This free service removes a significant obstacle to receiving consistent care.

How to Use Your Buckeye Health Plan

Choose a Primary Care Provider:

Your first step as a new member is selecting a primary care provider. This doctor becomes your main point of contact for most health concerns and coordinates referrals to specialists when needed.

You can search for in-network providers on the Buckeye website or by calling member services. Look for a doctor who’s conveniently located and accepting new patients.

Understanding Referrals:

Most specialist appointments require a referral from your primary care doctor. This process ensures proper coordination between providers and helps avoid unnecessary tests or duplicate treatments.

Contact your PCP’s office when you need specialized care. They’ll handle the referral paperwork and help you find an appropriate specialist within the network.

Using Your Member ID Card:

Always bring your Buckeye member ID card to appointments and when picking up prescriptions. This card contains essential information providers need to verify your coverage and submit claims.

If you lose your card, request a replacement immediately through member services or your online account portal.

Accessing Emergency Care:

True medical emergencies don’t require prior authorization. If you experience severe chest pain, difficulty breathing, uncontrolled bleeding, or other life-threatening symptoms, call 911 or go to the nearest emergency room.

Your plan covers emergency services even if you visit an out-of-network hospital. After receiving emergency care, follow up with your primary care provider within a few days.

Scheduling Appointments:

For routine care, call your doctor’s office directly to schedule appointments. Mention that you have Buckeye Health Plan coverage so they can verify your insurance before your visit.

Urgent but non-emergency issues can often be handled at walk-in clinics or urgent care centers within the network, which offer extended hours and shorter wait times than emergency rooms.

Managing Prescriptions:

Take your prescription to any participating pharmacy. You can also use mail-order pharmacy services for maintenance medications you take regularly this option often provides a 90-day supply at a lower total cost.

If your doctor prescribes a medication not covered by your plan, ask about alternatives or work with your doctor to request a formulary exception.

Final Thought

Understanding your Buckeye Health Plan benefits gives you the power to take charge of your health with confidence. When you know what’s covered and how to use each resource, everything from routine checkups to specialty care becomes easier to navigate. Don’t hesitate to lean on the tools, services, and support built into your plan they’re there to help you stay healthy, informed, and supported every step of the way.