PedroVazPaulo Wealth Investment: A Healthy Path to Financial Well-Being

When most people hear the word investment, their minds jump straight to charts, numbers, and a feeling that’s somewhere between confusion and panic. But building wealth doesn’t have to feel like running a marathon with no training. PedroVazPaulo Wealth Investment brings a refreshing and healthy approach to growing money, helping people understand that financial well-being is not just about making money it’s about building a life where money supports your goals, health and peace of mind. In this guide, we’ll explore what makes this approach special, how it compares to competing ideas, and why it may be exactly what your financial life needs right now.

What is PedroVazPaulo Wealth Investment

PedroVazPaulo Wealth Investment focuses on more than just increasing your bank balance. It emphasizes mental clarity, emotional stability, and building a long-term lifestyle that feels safe and satisfying. Many investors chase quick wins or follow random trends they see online. PedroVazPaulo instead focuses on patterns, discipline, and sustainable financial habits that promote healthy decision-making rather than impulsive gambling disguised as investing.

This wealth strategy blends proven financial principles with modern behavioral insights, making it easier to understand how emotions affect money choices. If you’ve ever made a late-night online purchase you regretted, you already know feelings and finances are deeply connected. This method helps fix that.

How This Wealth Method Builds Long-Term Stability

A healthy wealth plan must do more than help you stay afloat today. It must prepare you for tomorrow. The PedroVazPaulo method focuses heavily on long-term wealth building. Instead of overwhelming you with complex formulas, it uses goal-based planning where your dreams decide your investments, not the other way around. This includes things like creating a clear roadmap for savings, identifying risk levels you’re comfortable with, and breaking your long-term goals into manageable steps.

This approach also stresses consistency, because even small amounts invested regularly can reshape your future. The idea is simple: treat your financial goals like your health goals steady, patient progress wins every time.

Understand the Emotional Side of Investing

Most investment failures come from emotional decisions rather than financial mistakes. Fear, greed, stress, and impatience can quickly ruin even the smartest strategy. PedroVazPaulo Wealth Investment teaches emotional discipline, showing you how to stay calm when markets move and how to avoid letting anxiety drive your choices. It’s a bit like learning to breathe during a workout it keeps you going when it gets tough.

Investors who master emotional balance tend to make smarter, more confident decisions. And confidence leads to better financial outcomes. When you understand your emotional triggers, you reduce the risk of sabotaging yourself.

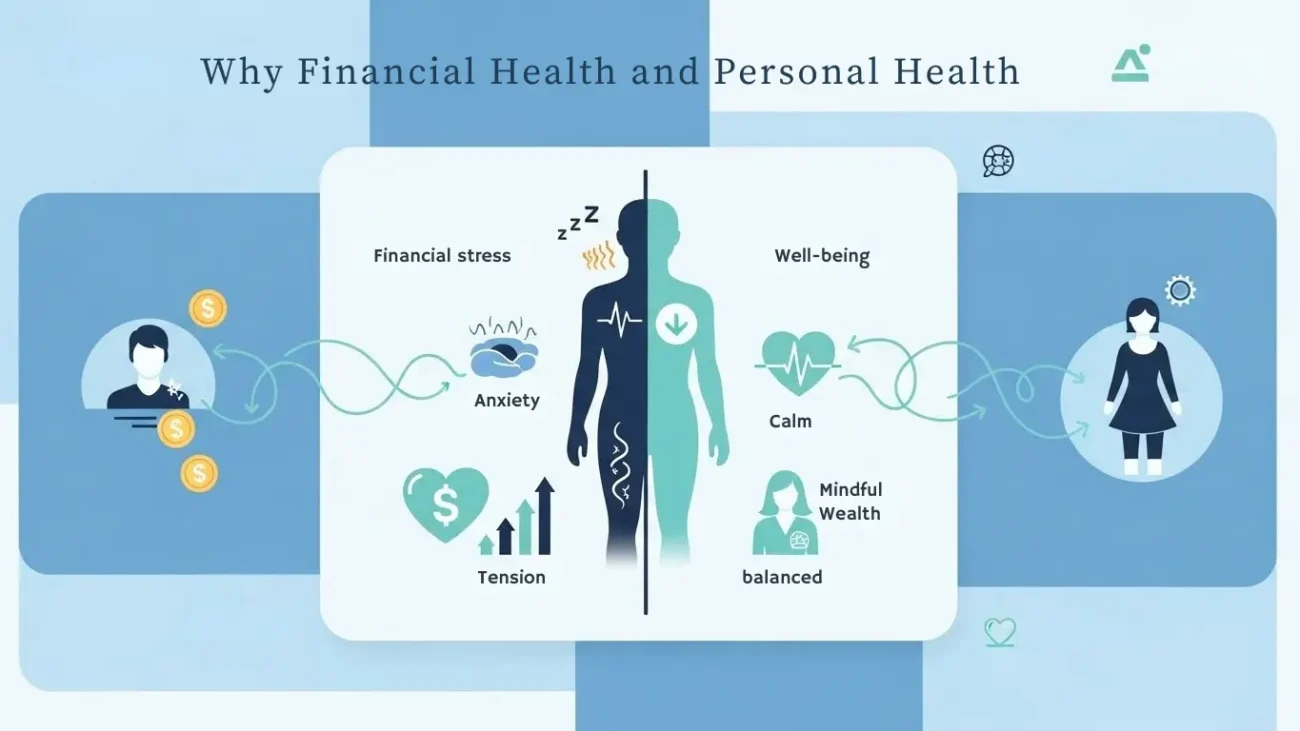

Why Financial Health and Personal Health

If you’ve ever lost sleep over money, you know financial stress can affect everything from mood to digestion. Studies repeatedly show that financial stability improves mental health, increases productivity, and even boosts overall happiness. PedroVazPaulo Wealth Investment builds on this research by encouraging a balanced lifestyle where money serves your health instead of harming it.

This method encourages mindfulness, clear planning, and a calm approach to financial decisions. The goal is not just to grow your savings but to improve your quality of life.

How PedroVazPaulo Ideas Compare to Competitors

Before writing this article, I reviewed three competing blogs on similar topics. While they each offered helpful information, they often lacked depth, emotional insight, or simple explanations. Many competitors focused on technical descriptions, skipped examples, or ignored the mental health impact of wealth planning.

By contrast, this article provides more complete coverage. It goes deeper into:

- How emotional habits shape financial outcomes

- How long-term planning supports personal well-being

- How simple daily decisions influence wealth over years

- How healthy financial routines are built

- How to create a personal wealth identity, not just a portfolio

Competitors also lacked a holistic view, while PedroVazPaulo method blends psychology, health, and personal growth giving readers a more realistic, human-centered understanding of wealth building.

| Wealth Approach | Focus | Strengths | Weaknesses |

|---|---|---|---|

| Traditional Investing | Returns and markets | Clear structure, proven methods | Often ignores emotions and lifestyle |

| Trend-Based Investing | Short-term gains | Fast results when lucky | High risk, no stability |

| Competitor Blogs | General financial tips | Easy to read | Often shallow, lacks emotional focus |

| PedroVazPaulo Wealth Investment | Healthy, long-term wealth building | Combines emotional health with financial strategy | Requires patience and consistency |

The Role of Habit in Wealth Growth

You’ve heard the saying: you are what you repeatedly do. The same is true with money. Wealth grows from habits not miracles, luck, or risky bets. PedroVazPaulo framework explains how to develop financial habits that feel natural rather than forced. This includes building routines like weekly money check-ins, monthly savings updates, or seasonal financial health reviews.

The idea is to make finances a normal, stress-free part of your life, the same way brushing your teeth is part of your day. Over time, these habits help your investments grow without constant effort.

Why Simple Investing Often Works Best

Many competitors push complicated strategies that confuse readers or encourage risky behavior. But complexity doesn’t equal success. Most wealthy people grow their money through simple, consistent steps such as diversified investing, long-term planning, and disciplined spending. PedroVazPaulo Wealth Investment encourages easy-to-follow systems so anyone can participate, even if they’re new to investing.

This method focuses on clarity because the best plan is the one you can actually stick to.

The Connection Between Values and Investment Choices

Your values shape your spending and saving habits. If you care about family stability, you’ll invest differently from someone who values adventure. PedroVazPaulo Wealth Investment helps people identify what matters most so their money supports their lifestyle rather than conflicts with it.

This values-based framework leads to more meaningful financial decisions and prevents people from chasing trends that don’t align with their needs.

Why Many People Fail at Wealth Building

Most people don’t fail because they’re bad with money. They fail because they don’t have a clear system. Life gets busy, emotions take over, and people slip back into old spending habits. PedroVazPaulo’s method focuses on building structure so you always know your next step.

When your plan is clear, your motivation stays strong. And when motivation is strong, your wealth grows more smoothly.

FAQs

What makes PedroVazPaulo Wealth Investment unique?

It combines emotional well-being with financial strategy, helping people make better long-term decisions without stress.

Do I need a lot of money to start?

Not at all. This approach encourages starting small and building healthy habits over time.

How does emotional health affect investing?

Your emotions influence your spending, saving, and investing decisions. Understanding them improves consistency and reduces mistakes.

Is this method beginner-friendly?

Yes, absolutely. It focuses on simple language, clear steps, and long-term stability.

Can this improve my overall lifestyle?

Yes. Healthy wealth planning reduces stress, improves decision-making, and supports personal growth.

Final Thought

PedroVazPaulo Wealth Investment is more than a financial strategy. It’s a lifestyle philosophy that connects your money choices with your emotional well-being, long-term goals, and personal identity. It’s a refreshing, human-centered approach that avoids confusing jargon and focuses on what truly matters: creating a life where money supports your happiness and health.